One such report, published by the financial market research firm Fitch Ratings entitled, U.S. Banks: Rationalizing the Branch Network, expects that both fewer numbers of branches and different types of branches will be serving customers in the future. According to the report, the continuously increasing cost structure of banking, accompanied by a challenging revenue environment and higher capital requirements is prompting banks to evaluate all expense categories — especially their branch distribution system, which is one of the most significant expenses.

Past Branch Growth

For the past 30 years, branch growth continued unabated while the number of financial institutions declined by more than 50%. The growth occurred largely through consolidation and de-novo expansion, with the objective being to expand a bank's footprint and customer base and therefore low cost deposits and loans.

Expanding a bank's footprint was viewed by consumers as being synonymous with 'strength', and provided a bank the ability to market more cost efficiently. In the past, branches were also the primary form of distribution. The result was that markets with stronger economic activity became overbanked (similar to the growth of gas stations and car dealers in the past and drug stores today).

Branch Profitability

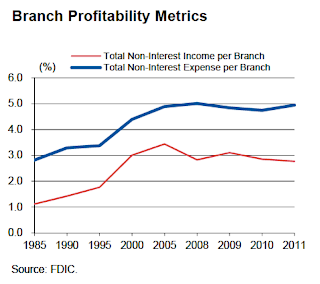

While in the past fees have subsidized branch networks, recent regulations (Reg. E and interchange regulations) have significantly reduced the ability to generate fee income (especially in lower income areas where branches were built to satisfy Community Reinvestment Act (CRA) requirements. Additional regulatory, human resource, real estate and compliance costs combined with the impact of a lower interest rate environment with lower spreads have further impacted the ability to support an expensive branch network.

As shown below, while non-interest income per branch has fallen off recently, non-interest costs continue to rise.

Changing Consumer Transaction Behaviors

As noted in my previous post, The Changing Definition of Convenience in Banking, a large percentage of consumers no longer equate branch distribution with convenience. While there are still some demographic segments who put a premium on the ability to transact at a local bricks and mortar facility (older demographics and small businesses), more and more consumers are banking from their desktop, ATM and mobile phone.

While many consumers still prefer to perform account opening and more involved financial transactions at a branch, the Fitch Ratings report references Fiserv's 2011 Consumer Trends Survey that indicated that the vast majority of households with internet access (80% or 79M) use online banking, and that the growth rate of using this channel is increasing rapidly. The study also showed a substantial increase in the use of the mobile channel.

In short, changing consumer transacting behaviors combined with continued technological advances and the lower costs to the customer and bank associated with online and mobile banking, will continue to support a shift from traditional branches to digital channels.

As shown below, while non-interest income per branch has fallen off recently, non-interest costs continue to rise.

Changing Consumer Transaction Behaviors

As noted in my previous post, The Changing Definition of Convenience in Banking, a large percentage of consumers no longer equate branch distribution with convenience. While there are still some demographic segments who put a premium on the ability to transact at a local bricks and mortar facility (older demographics and small businesses), more and more consumers are banking from their desktop, ATM and mobile phone.

While many consumers still prefer to perform account opening and more involved financial transactions at a branch, the Fitch Ratings report references Fiserv's 2011 Consumer Trends Survey that indicated that the vast majority of households with internet access (80% or 79M) use online banking, and that the growth rate of using this channel is increasing rapidly. The study also showed a substantial increase in the use of the mobile channel.

In short, changing consumer transacting behaviors combined with continued technological advances and the lower costs to the customer and bank associated with online and mobile banking, will continue to support a shift from traditional branches to digital channels.

In fact, Fitch expects increased technology spending over the near to intermediate term by the banks to continue to improve efficiency and streamline operations. While over the near term these additional technology expenses may offset cost savings from culling bank branches, longer term it should improve earnings and, therefore, returns to shareholders.

Impact of Reducing Branch Networks

Impact of Reducing Branch Networks

Fitch views the reductions in costs, and therefore improvement in earnings, as the biggest near-term positive to the reduction (or at least the reconfiguration) of branches. Fitch also believes that larger banks with more resources are in a better position to benefit from both a technology spending and cost-savings perspective.

In the study, Fitch notes that financial institutions unable to transform their branch models in the near term may actually suffer declining market share and customer attrition since consumers are demanding new ways of transacting with their bank. Alternatively, the increased use of technology could have the impact of making it easier for customers to move funds from one bank to another, which could have the unintended impact of increasing customer attrition rates and decreasing the stickiness of deposits as banks encourage channel shift.

Branch Transformation Alternatives

With the increased cost structure of branches, changing consumer transaction behaviors and potentially negative impact of simply closing branch offices, what might be the new banking distribution model? Fitch and Infosys both believe that technology, innovation and channel integration will play a major role in the transformation of bank distribution.

While new banking entities such as Simple and Movenbank can build a truly branchless bank, traditional financial organizations will need to find the right balance of branches and alternative channels to maintain a physical presence while still moving to a more feasible cost structure for the future. And while the announcements of branch closings are becoming more commonplace (BofA, KeyBank, PNC, HSBC, Capital One) to various degrees of controversy, the decision to close or modify a branch location will not be an easy one.

Digitally Enabled Branches

Some banks, like ABN AMRO have introduced a high tech teleportal that utilizes interactive technology without the presence of any staff. The branch can conduct the majority of the functions of a traditional branch through the interaction with a 3D screen that provides an effective, albeit different, branch experience.

Banks wanting to maintain a reduced staffing model without eliminating all direct human interaction have integrated digital and video technology to supplement a reduced staff in a smaller facility. Phone banking, self-service teller stations, online banking stations (using iPad style devices) and video web conferencing are being used in some banks for loan processing and even cross-selling.

ATM Modernization

With ATM capabilities expanding rapidly, some banks are increasing the presence and utilization of ATMs to handle more customer needs. We have already ATMs that can accept checks, make bill payments, provide change and even issue stamps and movie tickets. Future advances will include the potential for live video interaction and customer support and new ways to access cash utilizing mobile devices. These expanded capabilities will allow banks to reduce (or replace) a traditional bricks and mortar branch.

Enhanced Branch Value Proposition

For those branches that remain, banks must extract a higher value from the existing real estate through improved cross-selling, expanded services (brokerage, advisory, insurance, community outreach, etc.) and an overall enhanced customer experience. Citibank has gone as far as developing branches inspired from the Apple store, integrating modern design with technology and high customer service to improve engagement and sales (see Citi Rolls Out Its Version of the Apple Store in The Financial Brand).

With banks needing to reduce and reconfigure their distribution networks due to cost and revenue implications, disruption in bank distribution will continue. In an environment where customer fees have recently increased and dissatisfaction with the banking industry is still at high levels, any perceived cutback in service levels will be met with quick and widespread negative publicity and potential for further regulatory push back. This will leave banks with having to balance their need to change their distribution strategies with potential negative public sentiment.

It will eventually fall on the shoulders of bank marketers to soften the impact of any negative response through effective (and proactive) communication using all available traditional and digital/social media channels.

What do you think will be the best near and long term distribution strategy for banking? What will be the impact of the new banking entities that will enter the marketplace without branches? I would love to know.

Recent Related Articles on Bank Branch Transformation

Riding the Innovation Curve for Branch Transformation

Boiling the Frog: Time to Re-think Branches?

Branch Consolidations: Handle with Care

Bankers Talk Bluntly About Closing, Streamlining Branches

The Branch Killers Have It Backwards in Eyes of BB&Ts King

Bank Branches Are Dead

Recent Related White Papers

Infosys - Branch Bank of the Future: Transforming to Stay Relevant

Fitch Ratings - U.S. Banks: Rationalizing the Branch Network

With the increased cost structure of branches, changing consumer transaction behaviors and potentially negative impact of simply closing branch offices, what might be the new banking distribution model? Fitch and Infosys both believe that technology, innovation and channel integration will play a major role in the transformation of bank distribution.

While new banking entities such as Simple and Movenbank can build a truly branchless bank, traditional financial organizations will need to find the right balance of branches and alternative channels to maintain a physical presence while still moving to a more feasible cost structure for the future. And while the announcements of branch closings are becoming more commonplace (BofA, KeyBank, PNC, HSBC, Capital One) to various degrees of controversy, the decision to close or modify a branch location will not be an easy one.

Digitally Enabled Branches

Some banks, like ABN AMRO have introduced a high tech teleportal that utilizes interactive technology without the presence of any staff. The branch can conduct the majority of the functions of a traditional branch through the interaction with a 3D screen that provides an effective, albeit different, branch experience.

Banks wanting to maintain a reduced staffing model without eliminating all direct human interaction have integrated digital and video technology to supplement a reduced staff in a smaller facility. Phone banking, self-service teller stations, online banking stations (using iPad style devices) and video web conferencing are being used in some banks for loan processing and even cross-selling.

ATM Modernization

With ATM capabilities expanding rapidly, some banks are increasing the presence and utilization of ATMs to handle more customer needs. We have already ATMs that can accept checks, make bill payments, provide change and even issue stamps and movie tickets. Future advances will include the potential for live video interaction and customer support and new ways to access cash utilizing mobile devices. These expanded capabilities will allow banks to reduce (or replace) a traditional bricks and mortar branch.

Enhanced Branch Value Proposition

For those branches that remain, banks must extract a higher value from the existing real estate through improved cross-selling, expanded services (brokerage, advisory, insurance, community outreach, etc.) and an overall enhanced customer experience. Citibank has gone as far as developing branches inspired from the Apple store, integrating modern design with technology and high customer service to improve engagement and sales (see Citi Rolls Out Its Version of the Apple Store in The Financial Brand).

With banks needing to reduce and reconfigure their distribution networks due to cost and revenue implications, disruption in bank distribution will continue. In an environment where customer fees have recently increased and dissatisfaction with the banking industry is still at high levels, any perceived cutback in service levels will be met with quick and widespread negative publicity and potential for further regulatory push back. This will leave banks with having to balance their need to change their distribution strategies with potential negative public sentiment.

It will eventually fall on the shoulders of bank marketers to soften the impact of any negative response through effective (and proactive) communication using all available traditional and digital/social media channels.

What do you think will be the best near and long term distribution strategy for banking? What will be the impact of the new banking entities that will enter the marketplace without branches? I would love to know.

Recent Related Articles on Bank Branch Transformation

Riding the Innovation Curve for Branch Transformation

Boiling the Frog: Time to Re-think Branches?

Branch Consolidations: Handle with Care

Bankers Talk Bluntly About Closing, Streamlining Branches

The Branch Killers Have It Backwards in Eyes of BB&Ts King

Bank Branches Are Dead

Recent Related White Papers

Infosys - Branch Bank of the Future: Transforming to Stay Relevant

Fitch Ratings - U.S. Banks: Rationalizing the Branch Network

Jim, that was a big post. You tackled a lot. What I liked the best was the reference section at the end. A bibliography in a blog post...brilliant. Please make sure you continue to do this. Anybody else who blogs/writes on the web, you must do this too (myself included). Many do not do this. I applaud all who do.

ReplyDeleteAs I was reading your article I was remembering my time working with NationsBank on its acquisitions of Boatman's Bankshares and Bank of America. With each merger we not only evaluated how we migrated customers and how they would be cross or up sold, we also evaluated the branch network to make sure they were efficient. Like any well run retail institution, not all "stores" are created equal. The firm I worked for always made recommendations of closures or relocations. These decisions should always be ongoing in any industry. I sometimes thinks bankers backed off this process. When I really think about it, I also think it is always going on but no one is noticing. Unlike most industries, banks can not just simply close a branch. They must apply and get approval. When the regular press reports on banks closing banks I wonder if they know that part of the process.

The future of retail/business/commercial banking is not only exciting it is incredibly challenging.

You closed with two distinct questions. The best distribution strategy is not simple as it is different in every market. The successful businesses will be the ones who can leverage their knowledge base to grow their businesses profitably. This is both true in the near and long term. Data driven companies that can execute tend to do well versus those who do not. The if you build it they will come strategy is finally dead (I hope).

The other question about the non bank players entering the market. In the short term they will have zero impact. They have no scale. The top 4 banks own the market. Even long term, they will feel no material impact. At the other end of the spectrum, the bottom 4 banks will also feel no impact. These new financial service players are taking some business from banks and credit unions but it is spread out among the more than 10,000 financial institutions. Will these new players be successful? Yes. I think they will be incredibly successful. As time goes on there technological advantage will be mitigated as any FI will be able to have the same new tech they employ.

Great article Jim.

ReplyDeleteThe situation is mirrored here in the UK but the backlash is already beginning - see the response here to HSBC's branch closures - http://www.guardian.co.uk/money/2012/sep/21/hsbc-branch-closures-keep-banking-local?newsfeed=true

It will be interesting, as we face the end of "free banking" in the UK, how banks will manage this perceived loss of service as they close branches.

Its telling that the newest and upcoming players on the block; Virgin Money, M&S Bank and Handelsbanken, are all using branch/f2f servicing as part of their value proposition.

@jim, thank you for a useful analysis and collection of links. As an early adopter of online banking (1998) and payments (1995), I was scratching my head while observing the branch building boom during the 90s; I never looked into it, but several people referenced rationales like: competing for offline boomer business, real estate investments, brand building.

ReplyDeleteHowever, I think banks may be moving too fast by closing branches because I detect a hidden opportunity to transform the branch concept and how it relates to various client types. For example, laptop- and smartphone-toting mobile workers are a very attractive demographic that is underserved around the world. There's an opportunity to repurpose part of select branches' space to create coworking spaces for clients--and use a digital social network to add leverage. Imagine coworking spaces positioned between airport lounges and Starbucks. Here's a detailed picture: http://tinyurl.com/sbo-cow in case helpful.